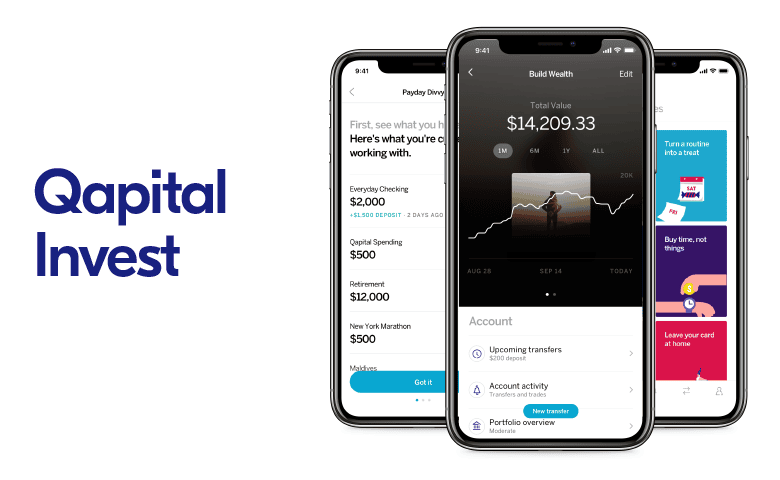

When creating Qapital Invest, we were determined to offer an investment product that would be embraced by both experienced and new investors for its robust features and accessibility. Knowing this would be the first investment account for many Qapital members, we focused on making Qapital Invest familiar and easy to use, without compromising on flexibility.

Whether you’re new to Qapital or a seasoned user, we’ll show you how you can start investing with the app and how we designed our investment strategy with you in mind.

How to invest with Qapital

We take a long-term approach to investing and encourage our members to do the same. Qapital members can invest for Qapital Goals just like they can save for them. For Invest Goals, members choose a target amount and a Time Horizon, which is when they’ll need the money for their Invest Goal.

We ask for a Time Horizon because not every goal is on the same timeline. For example, you may be saving for a down payment and for retirement — both are long-term goals, but vary as to when you would need the money. Once you’ve set your Time Horizon, we’ll recommend a portfolio in line with your goals.

If this is your first time setting up an Invest Goal with Qapital, you’ll receive a few questions that will assess your risk tolerance. This assessment is coupled with the Time Horizon you choose for your Invest Goal to drive our portfolio recommendation. Our recommendation is selected from five different portfolio options differentiated by how conservative or aggressive they are. Qapital recommends the most optimal portfolio likely to help you reach your goal in time.

From there, members just set Rules and start funding their investment accounts!

Unlike other investment providers that lock you into one portfolio for your entire account, each Qapital Invest Goal has its own recommended portfolio and can be customized with a unique set of rules that work with your financial lifestyle. We value flexibility and know your goals come in all shapes and sizes.

Our investing strategy

Diversification

Our investment strategy is based on Modern Portfolio Theory, developed by Nobel Prize winning economists. This portfolio theory is rooted in diversification, which refers to investing in different kinds of asset classes (which include stocks, bonds, real estate, and more). Asset classes are similar groupings of investments that, for the most part, move up or down as a whole. Some of the asset classes we invest in are:

- large-cap stocks, such as Google or Apple.

- international stocks, such as Nestle.

- investment grade bonds, such as from companies like Coca-Cola.

Diversification is a way of managing your risk by investing across a variety of different asset classes. Making investment decisions by trying to predict how a single stock or bond will perform can lead to big problems if you predict incorrectly. A diversified portfolio, on the other hand, can protect you from big losses suffered by a single asset class. This means a negative performance from some investments may be offset by the positive performance of others. Basically, with diversification, you’re not putting all your eggs in one basket. While it’s not a guarantee (few things in investing are), it’s agreed that diversification is one of the best ways to reduce risk in the long-term.

At Qapital, we invest in 12 different asset classes that have varying degrees of correlation with each other. This is important — if all your investments have the same correlation with each other, then you’re not really diversifying your risk.

Side note: Asset correlation refers to how the stock market performance of different asset classes relate to each other. Some asset classes have high correlation with others, meaning their performance, whether up or down, will affect that correlated asset class. In order to better spread out your risk, it’s often a good idea to invest in asset classes that have little correlation with each other.

Each portfolio is designed to help you benefit when the market, as a whole, is on an upward trend, and tries to protect you from losses if the market is on a downward trend.

DCA (Dollar-Cost Averaging)

DCA refers to an investment strategy that eschews trying to “time the market,” which, depending on who you ask, is an impossible feat for many investors. Rather than timing investments and buying or selling when a stock is predicted to go up or down, investors practicing DCA will invest set amounts of money at regular (often short) time intervals.

Again, this strategy is designed to protect against a market drop while still retaining the potential to maximize investment earnings. Take lump-sum investing, which is the opposite of DCA. Let’s say you invest $100 in a stock all at once. If it drops 10 percent by the end of the week, you’re entirely exposed to that risk and lose $10 as a result. That’s the downside to lump-sum investing.

But if you spread out the $100 investment and invest $25 weekly as directed by DCA, you’re only down $2.50 after the first week’s 10 percent drop. If the stock increases, you’re ready to reap those rewards without changing how much you invest in that stock.

This is why Qapital recommends you start every Invest Goal with the Set & Forget Rule. This ensures you invest on a regular basis to reduce your overall risk and to take advantage of market volatility (swings in the market).

Ready to invest?

People can get intimidated by investing, and for good reason. If you’re not sure whether you’re ready to invest, check out this article as a guideline. Our belief is that if you have long-term goals you can save toward, it makes sense to turn those into investment accounts. By putting your money to work and growing it via dividends, interest payments and more, you may be able to reach your goals faster than if you just saved for them.

Qapital, LLC is not a bank; banking services provided by Lincoln Savings Bank, Member FDIC, and other partner banks. Advisory services provided by Qapital Invest, LLC, an SEC-registered investment advisor. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Past performance is no guarantee of future results. Any historical returns or projections are hypothetical and may not reflect actual future performance. Investments in securities are not FDIC-insured and may lose value. This is not a complete description of Qapital Invest’s investment advisory services. For more details, click here. Brokerage services provided to Qapital Invest clients by Apex Clearing Corporation, an SEC-registered broker-dealer and member FINRA/SIPC. Copyright © 2023 Qapital, LLC - All rights reserved.

Share